If you are visiting Serbia and want to avoid paying ATM fees, you need to use the right banks. The good news is it’s pretty easy to do.

Although there are some banks you will need to avoid, there are others that will let you withdraw money from their ATMs without having to pay any additional fees.

This blog post is based on personal experience, not research and, although some of the “good” banks may become greedy in the future, at the time of writing the information is accurate and up to date.

There are a lot of banks in Serbia. I lived in Belgrade for a month but never tried them all because I only normally make one cash withdrawal per week. If a bank tried to hit me with fees, the only thing I withdrew was my card. I moved on and tried another one instead.

I’m writing this post because I don’t think it’s right for banks to charge foreign visitors for using their ATMs and I hope to make it easier for people who are visiting Serbia and want to avoid paying ATM fees during their time in Serbia.

UPDATE (09/04/2024): According to recent feedback, Erste Bank may be the only Serbian bank that doesn’t charge ATM Fees.

Good Banks to Use If You Want to Avoid Paying ATM Fees In Serbia

Opt Bank

I never used this bank during my time in Serbia. However, lots of site visitors are saying it doesn’t charge any fees and the feedback I am getting suggests it’s the best bank to try if you want to avoid being hit with ATM fees.

Serbian Post Office ATMs

Again, I never used this option myself but I’m hearing plenty of good things about the ATMs provided by the Serbian postal service so I am updating this blog post accordingly. In June 2023, Timothee confirmed he was able to take money from post office ATM without paying any fees.

Eerste Bank

Thanks to Anna for letting me know about Erste Bank via the comments section below. I was unfamiliar with this bank but she says she withdrew money in October 2023 and did not have to pay any ATM Fees.

NLB

NLB is a Slovenian bank that has branches all over Serbia. I used to use NLB cash machines in North Macedonia and they never added any extra costs to the transactions.

I’m happy to say the situation is the same in Serbia. If you use a card that was issued in another country, NLB doesn’t care. There will be no foreign currency fees.

UPDATE: NLB appears to have started to charge fees now. Thanks to Roza for the Update. You can see how much she paid by reading her comment in the comment section below.

UniCredit

UniCredit is another good option. It’s an Italian bank, but it very active in Serbia and every time you use an UniCredit ATM you won’t need to worry about any added fees at all.

If you are finding it difficult to find any ATMs that belong to NLB or UniCredit, it might be worth trying a Halkbank ATM.

Halkbank is actually a Turkish bank. Although I saw several Halkbank cash terminals in Belgrade, I never tried to use one because I didn’t need to withdraw any cash at the times I was near them. However, I used a Halkbank ATM in North Macedonia and managed to withdraw money without being charged. I think there is a good chance the Halkbank terminals in Serbia will be equally tourist-friendly so it might be worth a go.

UPDATE (June 2023): Unfortunately, UniCredit appear to be now charging ATM fees. However, if you check out the comments section at the bottom of the page, you will get some tips for alternative machines to use – machines that do not charge.

Banks to Avoid

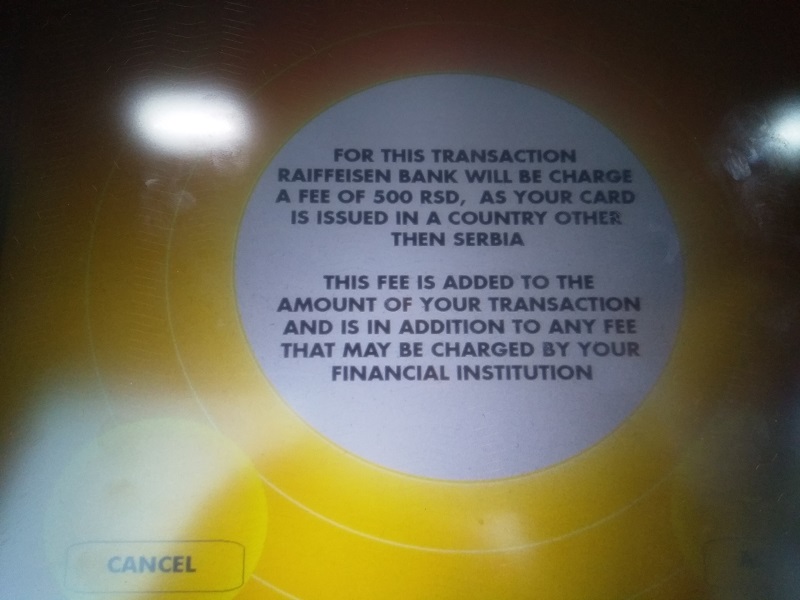

Raiffeisen Bank

Raiffeisen Bank is a Romanian bank, but it has branches in Serbia and other Balkan countries.

When I tried to use a Raiffeisen Bank ATM in Belgrade it wanted to add a 500 RSD (€4.23 / £3.80 / USD 4.82) fee.

Faced with a message like that, “cancel” is the thing to do.

Vojvođanska banka

Vojvođanska banka is another bank you need to avoid if you don’t want to pay ATM fees while you are visiting Serbia.

It also adds a 500 RSD transaction fee every time you use one of its machines.

Avoid Dynamic Currency Conversion

It’s not just a case of knowing which ATM to avoid if you don’t want to pay foreign currency fees. Some ATMs try and get you to accept the offer of dynamic currency conversion. If you don’t know what that is, Wikipedia has an article that explains it: https://en.wikipedia.org/wiki/Dynamic_currency_conversion

The main thing to know is, the machine will offer to do a conversion to your home currency. This can seem pretty nice because you get to know how much is going to be taken from your card and don’t need to do any sums. The problem is, there are hidden fees and conversion mark-ups that mean you actually end up paying more. If you want to get the best deal on your withdrawal, the best thing to do is refuse the offer of dynamic currency conversion and choose the other option instead.

To be honest, I can’t remember if any of the machines I used in Serbia offered dynamic currency conversion. I refuse it so often it’s become a reflex action.

How to Avoid Foreign Currency Fees from Your Own Bank

If you withdraw money abroad, using your normal debit card your bank will probably charge you foreign currency fees. If you use your credit card, your card issuer will do the same. These fees can cost more than the ones some ATMs try and charge.

Fortunately, there is a way to avoid foreign currency fees, but you have to open up a special account. It’s called a Wise Multi-Currency Account.

The account is free to open, there are no monthly or yearly fees, and it comes with a debit card.

The trick is to use your Wise card to withdraw cash from your ATMs and to pay for goods and services as well. You can save a fortune in bank fees. I know, I’m a perpetual traveller and use my Wise card every week.

You can manage the account from your computer or via a special app on your phone. These days, I mostly use the Wise app. When I need to withdraw money, I open the app, specify the amount and then send it from my bank. The funds usually arrive within just a few minutes.

When I withdraw money from an ATM, there is a fee but it’s much less than I would pay if I used one of the cards issued by my British or European banks. If you rarely go on vacation, this service may not interest you. However, if you travel a lot like I do, the savings add up week after week. You can find out more information about the Wise Multi-Currency Account HERE.

Hi! September 2024 and currently in Belgrade.

Erste bank charged 500 rsd 🙁 I managed to withdraw money with no fees at Halkbank

Hope this helps

Erste in Subotica charged 500d 26 June 2024. I haven’t tried this year but I am told I can get 5000d cash back from shops ??!!

Post office is chargin 480RSD to withdraw.

Just tried every bank on this page, unfortunately as of April 2024 only Erste Bank remains as one which takes no fee.

Пошта (Post of Serbia) has a 480 RSD fee.

Otp banka has a 600 RSD fee.

Thanks for the information. I’ve amended the article to point out the changes.

OTP is still fee free. Banca Intesa charges 500.

Thanks for the update Daniel. It’s good to know it’s still possible to make fee-free withdrawals in Serbia. This is no longer the case is some other Balkan countries.

Today… 15th feb 2024… To withdraw 10,000 dinar which amounts to €85.35 … I was charged €93 in total (otp atm) … atm showed me 10% mark up on the screen.

Banca Intesa said only worked with Bank Intesa cards (Beograd July 8 2024)

Unicredit does have a 500RSD withdrawal charge 28 Dec 2023

I confirm Erste bank ATM in belgrade city center did not charge me few days ago. However I have been charged 500 dinars today at a different Erste bank ATM in Vozdovaz using the same card!

post office ATM charged me 480din today. In Belgrade

Thanks Ljubica,

That’s obviously another ATM travellers need to avoid.

OTP bank is the only way to go. Confirmed today in Belgrade, no fee and good exchange rate.

Big thanks to the people posting updates.

Might be worth updating the original article in case some folks don’t check the comments.

Thanks, Jeremy. I’ve followed your advice and updated the article to reflect the changes that have taken place since I posted it.

Just used an OTP atm in Subotica and also no fee. Thank you for the article and comment section!

OTP Bank confirmed no fee

Thanks for the update David :0

June 2023: I can confirm that post office ATMs are now the only ones not taking fees when withdrawing cash in Serbia.

Thanks Timothee. That’s good to know. 🙂

I tried taking out money from a Serbian post office ATM on the 11th of July 2023 and was hit by a 480 RSD fee, which is weird because their website says they don’t have fees. Did this happen to anyone else or was it just me for some reason?

I just withdrew cash from Erste Bank ATM yesterday and no fees!

Hi Anna,

That’s good to know. Thanks. I’ll add it to the list. 😉

NLB taking 600

Uni 500 RSD

Thanks for the update Ròża 😉

Another bank that DOES NOT charge commision fees is OTP Bank.

Very good bank, I used it years ago when lived in Ukraine (also- no fees), in Serbia the situation is the same.

Just decline their conversion option and charge your card in local currency, which is Serbian Dinar (RSD).

Just withdrew 20,000 RSD in Sokobanja, no fees, after declining their conversion.

Hi,

That’s great to known. Thanks for taking the time to help make this page a useful resource for people who need to use cash machines in Serbia, 🙂

+1 for OTP

No fees in Užice

I can confirm, I just read update in this article and immediately tried to withdraw cash in OTP bank ATM

it doesn’t charge commission fee!

Thanks Nikolai.

It’s great when people provide updates. It helps keep the information up to date, making things easier for other travelers who are visiting Serbia and want to avoid unnecessary ATM charges 🙂

Hi there, unfortunately your info about UniCredit is not true anymore.

They offered me DCC, which I declined.

Later they gave me choice: either DCC or 500 RSD fee.

Also declined.

At this point, ATM freezed and took my card…

Vranje.

Luckily it was ATM connected to branch so it was quickly resolved…

ATMs of Post Office dont charge anything.

I just withdrew 20,000 RSD from one in Vranje.

Hi,

That’s bad news. Thanks for the update and information about the Serbian Post Office ATMs. It may help people who are visiting Serbia and want to get cash without paying any fees.